Prediction markets are one of the fastest-growing verticals in Web3. They turn opinions, probabilities, and future expectations into tradable markets. Instead of speculating on token prices or memecoins, users can trade on real-world events: elections, sports outcomes, crypto narratives, interest rate decisions, or even the approval date of a new ETF.

This new wave of on-chain markets has matured rapidly. Platforms like Polymarket now facilitate millions in daily volume and attract some of the smartest traders in crypto. They are simple enough for beginners yet deep enough to allow quantitative strategies, arbitrage, and yield-style plays.

But before diving into advanced strategies, it’s essential to understand what prediction markets are, how they work, and why they matter in the future of Web3.

Let’s break it down.

What Are Prediction Markets?

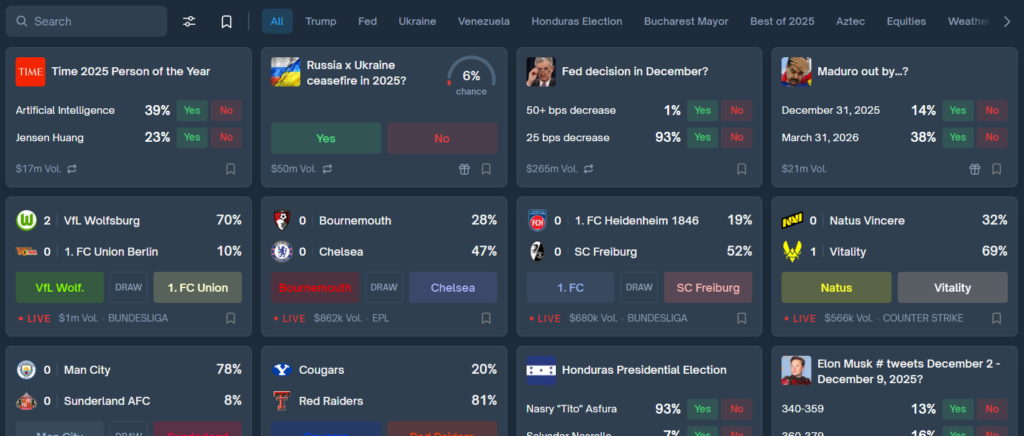

A prediction market is a platform where users trade on the outcome of future events. Instead of buying tokens, you buy probability. If you believe something will happen, you buy “YES” shares. If you believe it will not happen, you buy “NO” shares.

Prices typically move between $0.01 and $0.99, representing the market-defined probability of the event.

Examples:

• “Will Bitcoin exceed $100k before Dec 31?”

• “Will Candidate X win the 2024 election?”

• “Will ETH ETFs be approved by June?”

• “Will Apple announce an AI device this year?”

If the event resolves to “YES,” each YES share becomes worth $1. If “NO,” each NO share is worth $1.

Prediction markets use the collective intelligence of traders to form remarkably accurate probabilities. In many cases, these markets outperform analysts, polls, and expert opinions.

Why?

Because they rely on incentivized truth.

People who put money behind a belief behave differently than people who simply express an opinion.

How Do Prediction Markets Work?

Most Web3 prediction markets use an automated market maker (AMM) similar to DeFi protocols. Liquidity providers back the markets, while traders buy and sell YES/NO shares.

Here’s how they typically function:

1. Market Creation

A market is created with a clear, objective question and a verifiable resolution source (e.g., official government results, sports federations, or blockchain data).

2. Pricing

The price of YES or NO fluctuates as traders buy or sell.

– If YES trades at $0.65, the market believes there is a 65% probability of the event occurring.

– The remaining probability is reflected by the NO price at $0.35.

3. Trade Execution

Users place trades based on their belief, research, models, or pure speculation. Markets react in real time as more liquidity enters.

4. Resolution

Once the event concludes, the oracle resolves the market and winning shares become redeemable for $1 each.

5. Profits

– Buy low probability that becomes reality? Profit.

– Bet against something that fails? Profit.

– Enter liquidity early and exit before volatility? Profit.

Prediction markets reward accuracy and timing, not hype.

Top Prediction Market dApps in Web3

While Polymarket is the breakout star, several platforms contribute to the ecosystem:

1. Polymarket

The most liquid, most popular, and most accurate prediction platform today. Runs on Polygon and offers deep markets across politics, crypto, culture, sports, technology, and global events.

Visit: Polymarket

2. Zeitgeist

A Substrate-based prediction market focused on decentralized governance and community forecasting.

Visit: Zeitgeist

3. Azuro

A liquidity layer powering UI-agnostic betting and prediction experiences, primarily used for sports markets. (older)

4. PredictX / Hedgehog

Smaller but innovative platforms experimenting with custom market mechanics and on-chain resolution frameworks. (older)

5. Catnip / Augur Legacy

Early prediction protocols that paved the way, now mostly historical references but foundational in design. (older)

Prediction markets are becoming a core part of Web3’s financial stack, bridging information, governance, AI agents, and user sentiment. And leading this movement is Polymarket.

Introduction to Polymarket

Polymarket has exploded into mainstream relevance. From presidential elections to Bitcoin ETF approvals, journalists, hedge funds, analysts, and even political strategists now monitor Polymarket probabilities daily.

Why is Polymarket so successful?

1. Extremely intuitive UX

Most users can understand a YES/NO trade within seconds.

2. Deep liquidity

Millions in capital back the markets, enabling real price discovery rather than random volatility.

3. Fast & cheap trading on Polygon

Low fees mean users can actively trade without friction.

4. Real-world relevance

Every market is tied to something that actually matters, making the experience more engaging than speculative tokens.

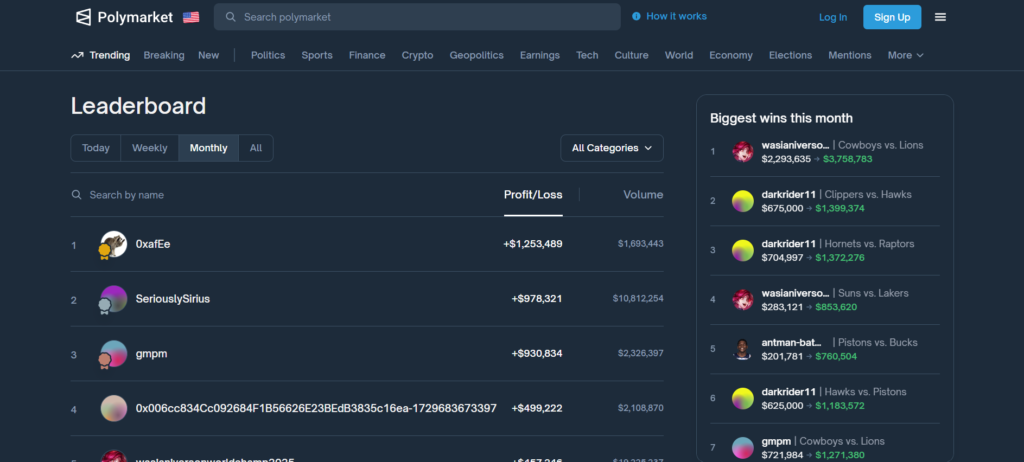

5. Transparent track record

Polymarket publishes leaderboards of the most profitable traders, and this transparency is what makes advanced strategies such as copy-trading possible.

Which brings us to the part TokenHunters readers love most:

How to automate Polymarket trading and copy the smartest wallets in the game.

How to Copy-Trade the Most Profitable Polymarket Users Automatically

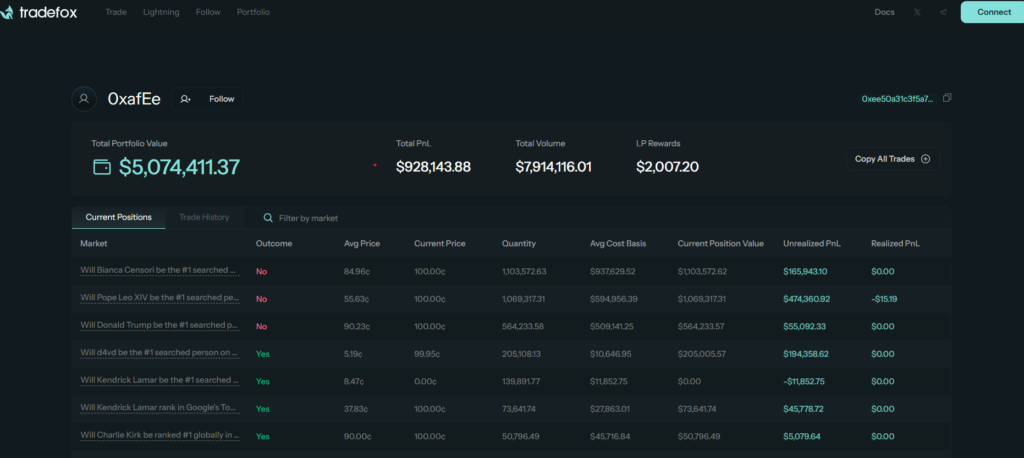

One of the biggest advantages of on-chain prediction markets is transparency. Every trade is recorded on-chain, and every wallet has a public performance history.

This means you don’t need to guess who the best traders are.

You can see them.

You can track them.

And now, with the right tools, you can automatically mirror their trades 24/7.

Below is a complete guide to automating Polymarket copy-trades using TheTradeFox. This turns prediction markets into a passive strategy powered by elite traders.

Polymarket Copy Trading Automatisation - Full Guide

Step 1 – The Target

Your goal here is to identify top-performing Polymarket traders worth copying.

Visit: https://polymarket.com/

Connect and log in.

Navigate to the Leaderboard.

Filter categories with the highest monthly profits.

Open the profiles of the top 10 most profitable users.

Review their performance history:

• Win rate

• Market categories

• Risk profile

• Consistency over timeFound a high-performing trader?

Copy their wallet address.

This wallet will become your automated trading signal source.

Step 2 – Lock-in

Now you will connect that wallet to this FOX copy trade tool to begin copy-trading.

Visit: Copy-trade Tool

Connect and log in.

Click Deposit.

Deposit some USDC (minimum $10).

Wait for the deposit to be confirmed.

Navigate to Followers in the menu.

Paste the Polymarket trader’s wallet address.

Click Copy Trader.

Configure your settings.

Example settings:

• Spend: $5

• Entry allocation: 33%

• Mode: Follow exit

These settings ensure your account automatically enters and exits positions whenever the selected trader does.

Step 3 – Cash In & Repeat

This final step is where the automation truly shines.

Sit back and monitor your trades as they execute automatically.

The “Copy Trader” button will transform into “Manage Trade.”

If needed, adjust your exposure or swap to another profitable wallet.

Repeat the cycle to scale profits over time.

You now have automated, transparent, and data-driven exposure to the best minds on Polymarket, without spending hours on research or execution.

Why This Strategy Works

Copy-trading in prediction markets is fundamentally different from copy-trading in volatile token markets:

1. Prediction markets reward accuracy, not hype

Top traders on Polymarket succeed because they understand probability, not because they ape into memecoins.

2. Win/loss data is publicly visible

You can verify performance before committing capital.

3. Market outcomes are binary

Trades resolve quickly, generating frequent realized PnL instead of long, uncertain holding cycles.

4. Low entry thresholds

With as little as $10, anyone can start testing and scaling the strategy.

5. Automation eliminates emotional trading

Fear, greed, and hesitation are removed from the equation.

This creates one of the cleanest and most accessible alpha strategies available today in Web3.

The Next Wave of Web3 Trading

Platforms like Polymarket demonstrate that Web3 is not just about tokens, it’s about intelligence, transparency, and collective forecasting.

And with automated copy-trading, the barrier to profiting from these markets has never been lower.

TokenHunters will continue tracking new tools, hidden strategies, and profitable traders so our community stays ahead of the curve.

If you want to explore Polymarket, run prediction strategies, or automate your portfolio, now is the time.

Stay sharp.

Stay early.

And as always, hunt smarter.

Comments